Selcom Pesa, the innovative mobile money application launched by Selcom Microfinance Bank Tanzania Limited, is rapidly gaining traction in the country’s vibrant digital financial services landscape. Since its official unveiling in February 2025, the app has distinguished itself with a focus on affordability and accessibility, positioning itself as a compelling alternative in a market traditionally dominated by established telecom-led mobile money operators.

Selcom Pesa’s growth can be attributed to its unique value proposition, particularly its commitment to offering some of the lowest transaction fees in Tanzania. This strategy, highlighted by the “5 kwa Jero” campaign which allows users to perform five daily transactions for just TZS 500, has resonated strongly with a population keenly aware of mobile money transaction costs.

Recent enhancements further underscore Selcom Pesa’s commitment to innovation and user convenience. The app now offers transactional bundles directly at checkout, allowing users to select “Kwa Jero” (daily), “Wiki Boost” (weekly), or “Hello Mwezi” (monthly) bundles, providing greater control and flexibility over their spending. This innovative approach to bundling services caters to diverse user needs and usage patterns.

The app’s integration with the Tanzania Instant Payment System (TIPS) further enhances its cost-efficiency, allowing for near-zero cost transfers for the bank, a benefit passed directly to the consumer.

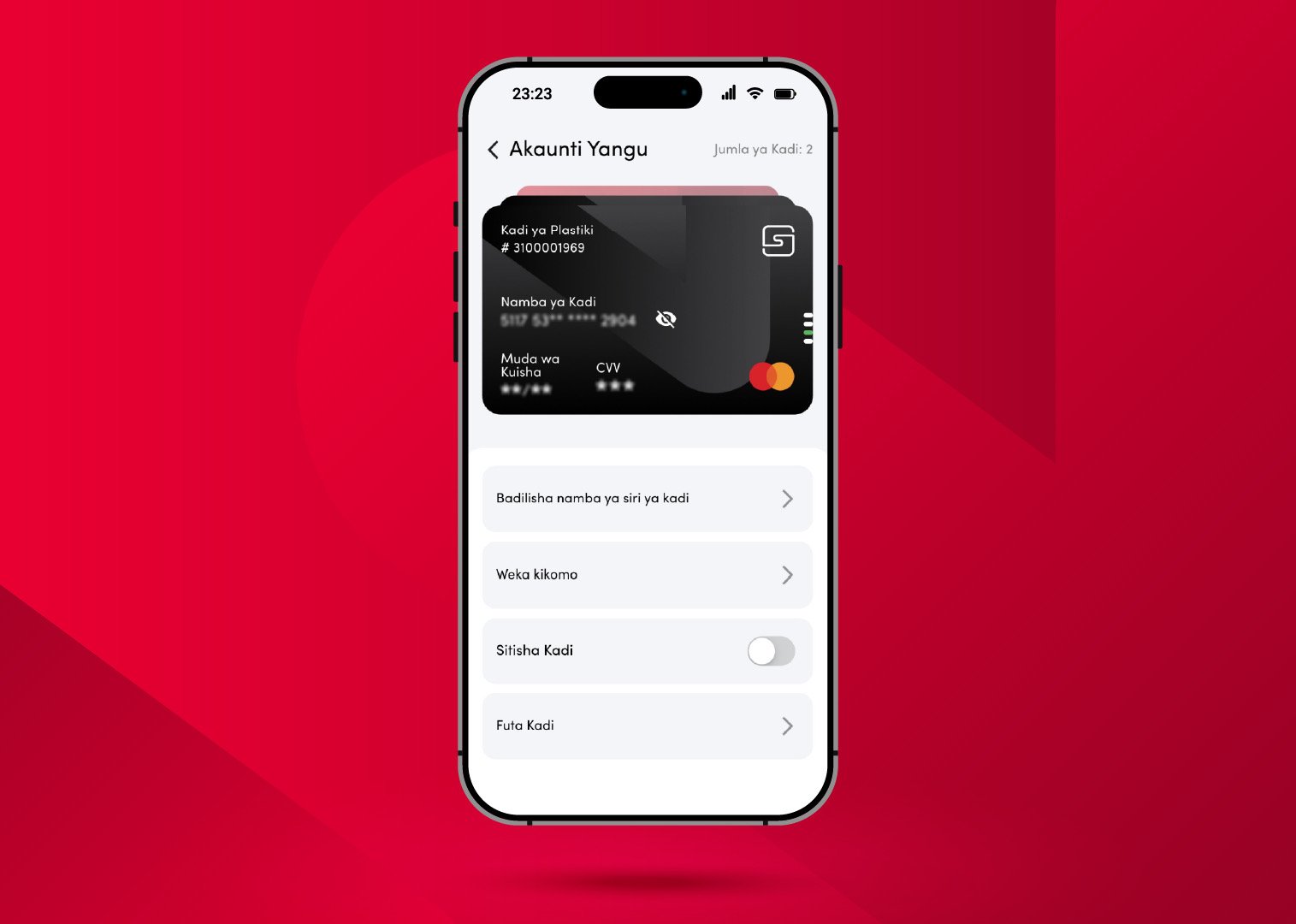

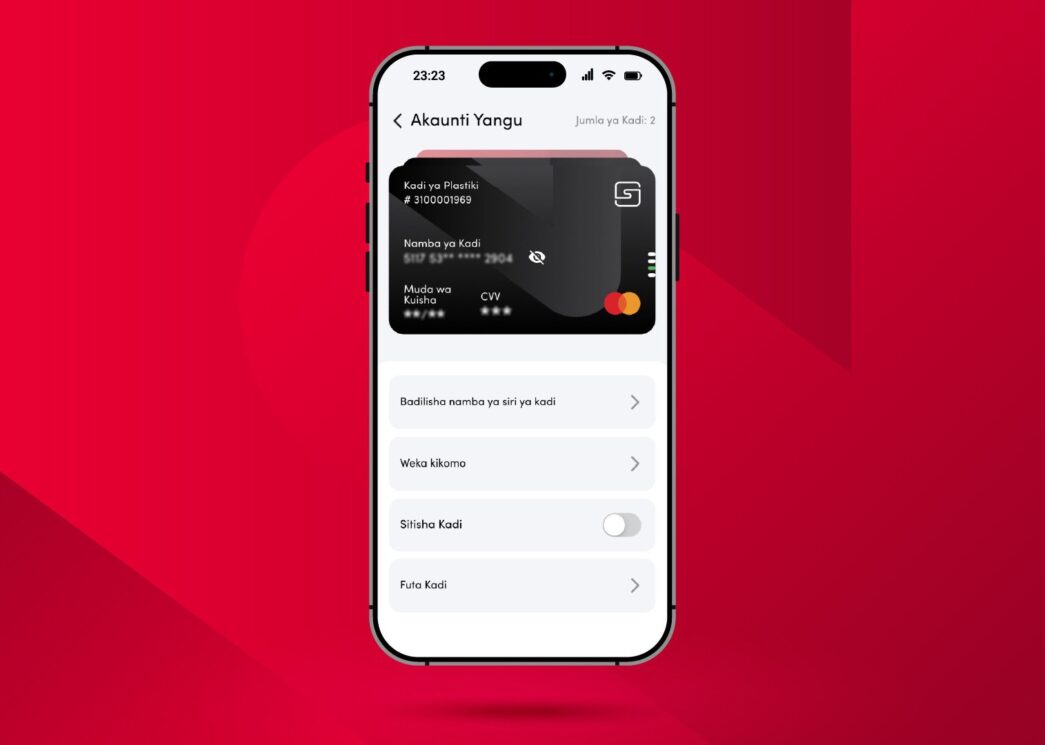

The app provides a comprehensive suite of digital financial services, including money transfers to local and international banks and other mobile wallets, utility bill payments, merchant payments via QR code and “Lipa Namba,” and even a digital savings feature called “Kibubu.” A significant draw for users is the integrated Selcom Pesa Mastercard, enabling free online payments and ATM withdrawals, expanding the reach of digital transactions beyond the traditional mobile money ecosystem.

While precise adoption rates for Selcom Pesa are still emerging given its relatively recent launch, the widespread positive reception and its competitive pricing strategy suggest a promising trajectory. The app’s digital-first approach allows for seamless self-registration through phone numbers and NIDA IDs, further simplifying the onboarding process for new users.

The Tanzanian mobile money market is characterized by robust growth, with over 61.88 million accounts and billions of transactions recorded in 2024. While giants like M-Pesa, Airtel Money, and Mixx by Yas hold significant market share, Selcom Pesa’s entry with its distinct focus on affordability and comprehensive features indicates a healthy and evolving competitive environment.

This increased competition is expected to benefit consumers through more diverse and cost-effective digital financial solutions, aligning with Tanzania’s broader vision of driving financial inclusion and digital transformation. Selcom Pesa is clearly staking its claim as a significant player in this exciting period of digital innovation.